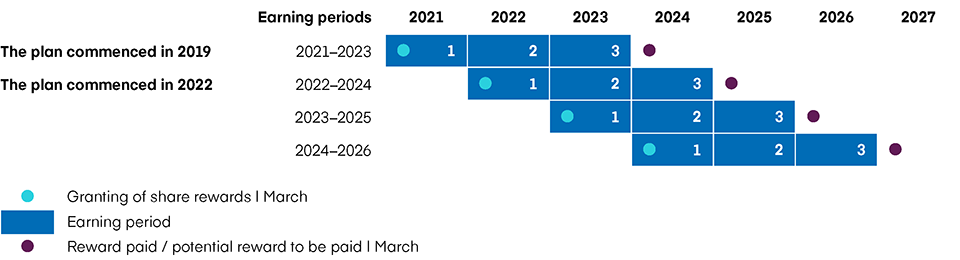

The Group has on share-based incentive plan in force for key persons of the Group that commenced in 2022.

The plan that commenced in 2022 includes three earning periods, which are the calendar years 2022–2024, 2023–2025 and 2024–2026. The Board of Directors decides on the earnings criteria and on targets to be established for them at the beginning of each earning period. One earning period, calendar years 2022–2024, commenced in 2022. One earning period, calendar years 2023–2025, commenced in 2023. One earning period, calendar years 2024–2026, commenced in 2024. The potential rewards of the plan for the earning periods commencing in 2022, 2023 and 2024 are based on achieving the Orion Group’s operating profit and net sales targets.

The target group of the plan consists of approximately 60 people. The total maximum amount of rewards to be paid on the basis of the plan is 760,000 Orion Corporation class B shares and a cash payment corresponding to the value of the shares. The total maximum amount includes a separate, so called reward for commitment part that the Board of Directors can use by a separate decision during the years 2022–2026. The maximum amount of the reward for commitment is no more than 100,000 shares and a cash payment corresponding to the value of the shares. By 31 December 2023, no Orion Corporation B shares had been paid as rewards under this plan.

There are no restriction periods in the plan, as the duration of each earning period is three years. According to the terms and the conditions of the plan, the rewards to be paid to a key person shall be limited, if the limits set for the rewards to be paid from the plan for one calendar year are exceeded. Remuneration paid to key person is decreased as follows if the set limits are exceeded:

- if the value of the total reward exceeds the value of the Gross Annual Salary multiplied by 2.5 of the key person at the time of payment of the reward, the excess part of the reward is reduced by 50%, and

- if the value of the total reward exceeds the value of the Gross Annual Salary mutiplied by 3 of the key person at the time of payment of the reward, the excess part shall not be paid.

The plan that commenced in 2019 ended in 2023. The plan included five earning periods, which were the calendar years 2019, 2019–2020, 2019–2021, 2020–2022 and 2021–2023. The Board of Directors decided on the earnings criteria and on targets to be established for them at the beginning of each earning period. Three earning periods, calendar year 2019, calendar years 2019–2020 and 2019–2021, commenced upon implementation of the plan. One earning period, calendar years 2020–2022, commenced in 2020. One earning period, calendar years 2021–2023, commenced in 2021. The potential reward of the plan for the earning periods commencing in 2019, 2020 and 2021 were based on achieving the Orion Group's operating profit and net sales targets.

The target group of the plan consisted of approximately 50 people. The total maximum amount of rewards to be paid on the basis of the plan was 700,000 Orion Corporation B shares and a cash payment corresponding to the value of the shares. The total maximum amount included a separate, so called reward for commitment part that the Board of Directors could use by a separate decision during the years 2019–2023. The maximum amount of the reward for commitment was no more than 100,000 shares and a cash payment corresponding to the value of the shares. By 31 December 2023, a total of 302,472 B shares had been paid as rewards under this plan.

Under the plan, shares received based on one-year and two-year earning periods could not be transferred during the restricted period determined in the plan. There were no restricted period for the three year earning periods. According to the terms and the conditions of the plan, the rewards to be paid to a key person from the plan in force were limited, if the limits set for the Orion Group long-term incentive plan rewards for one calendar year were exceeded. Remuneration paid to key person was decreased as follows if the set limits were exceeded:

- if the value of the total reward exceeds the value of the Gross Annual Salary multiplied by 2 of the key person at the time of payment of the reward, the excess part of the reward is reduced by 50%, and

- if the value of the total reward exceeds the value of the Gross Annual Salary mutiplied by 2.5 of the key person at the time of payment of the reward, the excess part shall not be paid.

Under plans that commenced in 2019 and 2022 for the earning periods currently in effect, the details are shown in the table below.

| Earning periods currently in effect | 2024-2026 | 2023-2025 | 2022-2024 | 2021-2023 |

| Start date of earning period | 1 Jan 2024 | 1 Jan 2023 | 1 Jan 2022 | 1 Jan 2021 |

| End date of earning period | 31 Dec 2026 | 31 Dec 2025 | 31 Dec 2024 | 31 Dec 2023 |

| Grant date of share rewards | 8 Feb 2024 | 23 Mar 2023 | 11 Mar 2022 | 3 Mar 2021 |

| Fair value of shares at granting, EUR | 42.74 | 41.55 | 39.56 | 33.58 |

The rewards under the plans shall be paid partly in the form of the Company’s B shares and partly in cash. Rewards under the plans have been paid and potential future rewards shall be paid as follows:

| Earning period | Reward paid / potential reward to be paid |

| 2019 | 2 March 2020 |

| 2019-2020 | 1 March 2021 |

| 2019-2021 | 1 March 2022 |

| 2020-2022 | 1 March 2023 |

| 2021-2023 | 1 March 2024 |

| 2022-2024 | 2025 |

| 2023-2025 | 2026 |

| 2024-2026 | 2027 |

Authorisations of the Board of Directors concerning remuneration

The Board of Directors has an authorisation confirmed by the Annual General Meeting held on 23 March 2022 to decide on a share issue in which shares held by the Company can be conveyed in a targeted issue as part of the Company's incentive system. The terms of the authorisation have been published in a stock exchange release on 23 March 2022.